Federal

Enhanced Support Measures Announced for SBA’s Disaster Loan Program

In an endeavor to better aid small businesses and disaster survivors, the Small Business Administration (SBA) has revealed sweeping changes to its disaster lending scheme. As of July 31, 2023, these modifications will be applicable to every federally declared disaster, focusing on providing more adaptable and cost-effective loans.

Isabella Casillas Guzman, the SBA Administrator, emphasized the institution’s determination to allocate maximum resources towards communities grappling with the escalating frequency of natural disasters, a consequence of climate change. Guzman mentioned, “By introducing these adjustments, we’re hoping to bolster recovery efforts of nonprofits, small businesses, homeowners, and renters, enabling their communities to regain their strength and vitality.”

Highlighting the transformative nature of the updates, Bailey DeVries, who serves dual roles as the associate administrator for both investment and innovation and capital access, mentioned that such alterations hadn’t been seen in close to thirty years. DeVries added, “By raising the limits of home disaster loans substantially, we aim to ensure communities possess ample funds to reconstruct and bounce back.”

Adding to this sentiment, Francisco Sánchez Jr., from SBA’s Office of Disaster Recovery and Resilience, expressed that these reforms are part of a broader strategy to revamp the SBA’s approach to disaster preparedness and response. This strategy seeks to invest more capital in rebuilding communities and amplifying resilience against impending calamities.

Noteworthy Amendments Comprise:

- Elevated Loan Ceilings: Home disaster loans, earmarked for primary residences, have seen an increase, now capped at $500,000 from a previous $200,000. Meanwhile, personal property loan maximums have also witnessed a jump from $40,000 to a substantial $100,000.

- Landscape Limit Abolished: The pre-existing $5,000 restriction on landscaping expenditures has been removed, now constrained only by the comprehensive real estate repair budget.

- Lengthened Payment Grace Period: A shift from a 5-month to a 12-month initial payment deferment period for all disaster loans offers victims a longer cushion before commencing repayments.

- Interest Reliefs: The first year’s interest from the primary disbursement date for all disaster loans will be nullified. This amendment assures that the payment hiatus provides tangible financial alleviation.

- Augmented Mitigation Loans: Property proprietors can now utilize disaster loan capital to safeguard against a wider array of disasters, thanks to eased restrictions.

- Collateral Stipulations: The SBA has chosen to forgo blanket liens on business commodities that don’t yield liquidity during potential defaults.

- Streamlined Reconsideration Documentation: Enterprises are no longer mandated to furnish financial statements during every reconsideration or appeal for previously rejected submissions.

- Broadened Eligibility: Now, consumer or marketing cooperatives can qualify for the Economic Injury Disaster Loan (EIDL) and Military Reservist Economic Injury Disaster Loan (MREIDL) schemes.

Guzman had previously, in 2022, opted to nullify the interest for the inaugural year and inherently prolong the primary payment deferment span to 12 months for disasters proclaimed between September 21, 2022, and September 30, 2023. These revisions are here to stay, extending their influence on all subsequent disaster loans post-September 30, 2023.

Federal

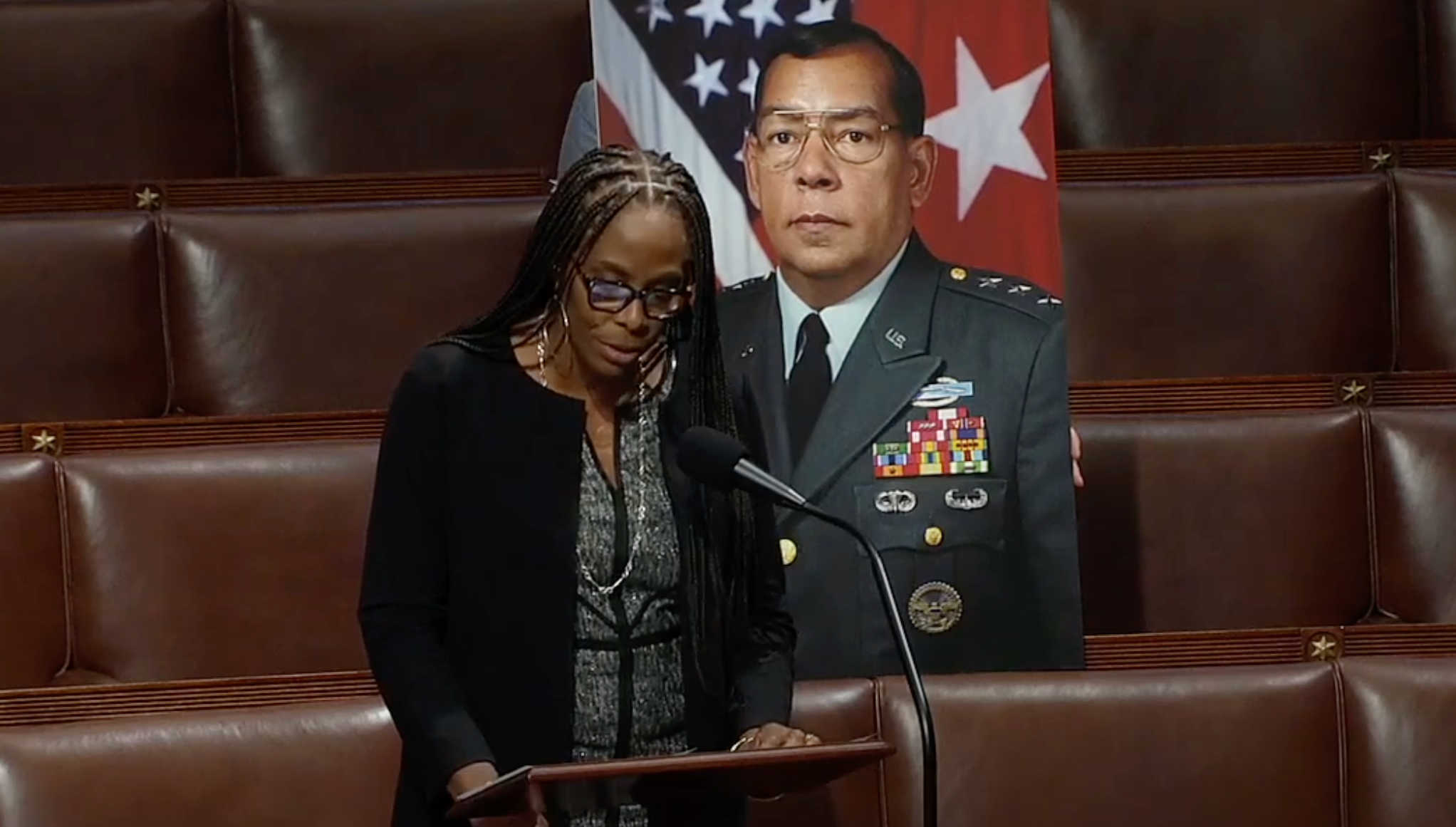

Plaskett’s Bill to Honor Virgin Islands Hero Passes House

In a notable legislative milestone, Congresswoman Stacey Plaskett successfully led the passage of a bill through the House to rename a post office in St. Croix in honor of a distinguished local military figure.

The bill, designated H.R. 5034, proposes renaming the post office located at 2119 Market Square in Christiansted as the “Lieutenant General Samuel E. Ebbesen Post Office.”

Lt. General Samuel E. Ebbesen, a native of St. Croix, is renowned for his extensive military service, business acumen, and community leadership. His illustrious military career includes commanding the First Brigade, 101st Airborne (Air Assault) Division at Fort Campbell, Kentucky, and the 6th Infantry Division at Fort Wainwright, Alaska. He also served as the commander of the Second U.S. Army at Fort Gillam, Georgia.

Expressing his appreciation for the honor, Lt. General Ebbesen said, “I continue to be humbled by the efforts of Representative Stacey Plaskett and her office to honor my service. Being present to witness us being one step closer to the designation of the Market Square, Christiansted Post Office in my name is truly an honor.”

Ms. Plaskett emphasized the significance of acknowledging Lt. General Ebbesen’s exemplary life and service, stating, “The naming of the Market Square Post Office on St. Croix as the Lt. General Samuel E. Ebbesen Post Office will enshrine his legacy and serve as a testament to the thousands of Virgin Islanders who answer the call to duty in our armed forces. Recognizing Lt. General Ebbesen’s service through this federal building designation is important.”

With its passage in the House, the bill will now move to the Senate for consideration. If approved, it will be sent to President Biden for his signature into law.

Federal

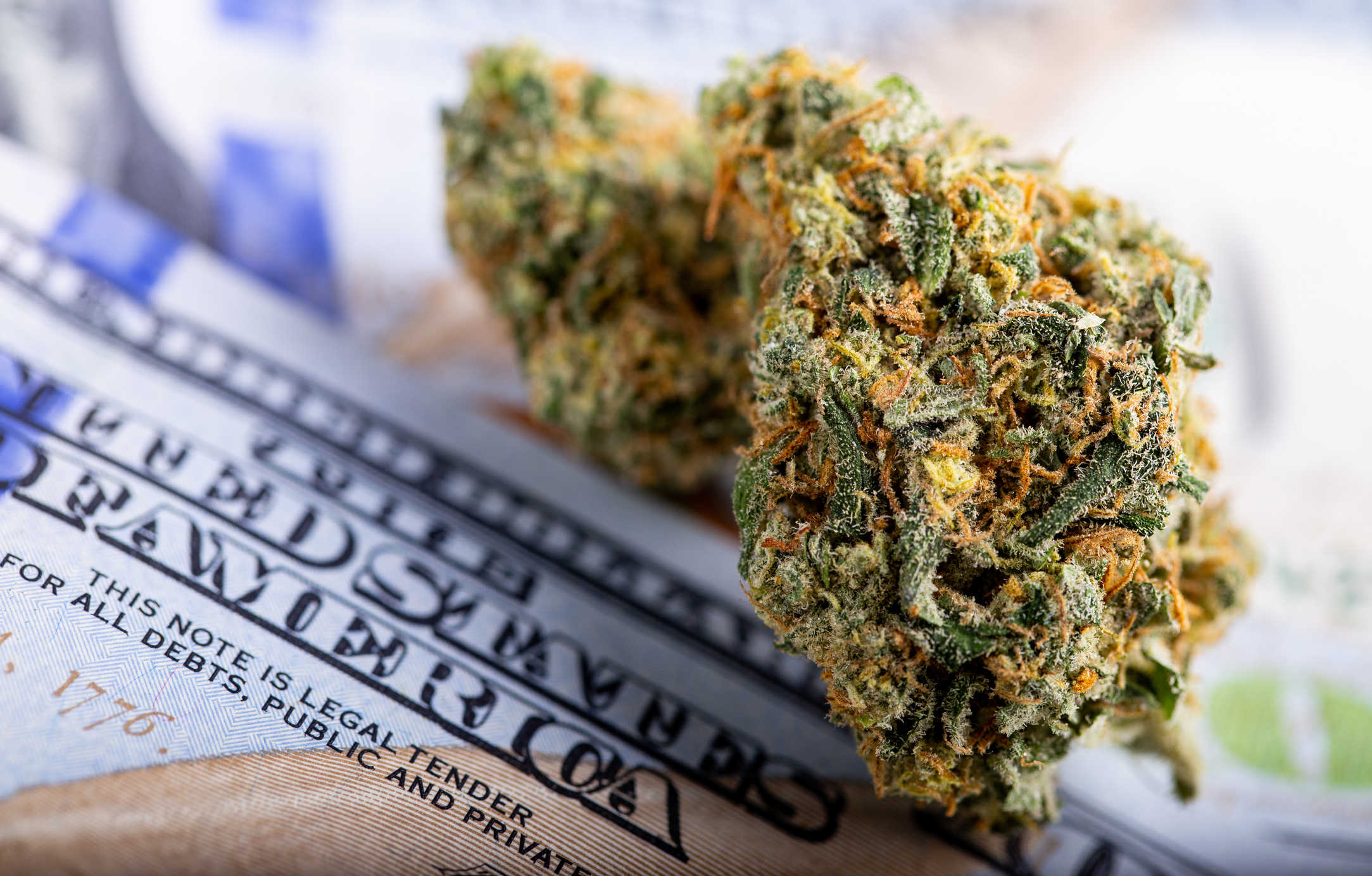

U.S. DOJ Moves to Reschedule Marijuana to Ease Criminal Penalties

The U.S. Department of Justice has announced that Attorney General Merrick Garland has initiated a process to reschedule marijuana from a Schedule I to a Schedule III drug under the Controlled Substances Act (CSA). This proposed rulemaking, submitted to the Federal Register, could significantly change marijuana’s legal status, reduce federal criminal penalties, and acknowledge its accepted medical use in the U.S.

Marijuana has been a Schedule I drug since the CSA was enacted in 1970. On October 6, 2022, President Joe Biden requested a scientific review of marijuana’s classification. Following recommendations from the Department of Health and Human Services (HHS) in August, Garland sought legal guidance from the Justice Department’s Office of Legal Counsel (OLC). Based on HHS’s findings and OLC’s advice, the Attorney General has now begun the rulemaking process to reclassify marijuana.

Rescheduling a controlled substance involves a formal procedure that includes public notice, an opportunity for comment, and an administrative hearing. During this process, the Drug Enforcement Administration (DEA) will collect and review public input to make a final determination. Until then, marijuana remains a Schedule I substance.

Historically, marijuana’s classification has faced numerous legal challenges and petitions for rescheduling. Initially classified as Schedule I, marijuana was deemed to have a high potential for abuse, no accepted medical use, and a lack of safety under medical supervision. Despite various attempts to change this status, the DEA has repeatedly denied such requests, adhering to its five-part test for determining a drug’s “currently accepted medical use” (CAMU).

The recent HHS recommendation was based on a two-part inquiry: assessing whether licensed healthcare providers widely use marijuana for medical purposes and whether there is credible scientific support for at least one medical use. HHS concluded that marijuana meets these criteria, supporting its reclassification to Schedule III.

This potential rescheduling raises several legal and regulatory questions. An April 2024 memorandum from the OLC stated that the DEA’s current approach to determining CAMU is too narrow. The OLC asserted that HHS’s two-part inquiry is sufficient to establish CAMU and emphasized that DEA must give significant weight to HHS’s scientific and medical determinations in the rulemaking process.

Additionally, the memorandum addressed compliance with the Single Convention on Narcotic Drugs and the CSA. It concluded that neither mandates marijuana’s placement in Schedule I or II, and that DEA can meet international obligations by rescheduling marijuana to Schedule III with appropriate regulatory controls.

The rulemaking process will include public participation, with opportunities for comments and a hearing before a final decision. The outcome could change marijuana’s classification, impacting its legal status and medical use availability in the United States.

Federal

Court Decision Paves Way for Integration of Caneel Bay Resort into National Park

A pivotal ruling from a U.S. Circuit Court judge has mandated the transfer of ownership of the Caneel Bay Resort’s buildings and infrastructure to the U.S. Department of the Interior. This decision enables the National Parks Service to proceed with the redevelopment of the iconic resort.

The legal tussle over the rightful ownership of the property began in 2022, involving EHI Acquisitions LLC and the United States Government. Originating from a unique ownership arrangement crafted between 1977 and 1983, the Caneel Bay Resort was built on a 150-acre tract that was part of a larger 5,000-acre donation to the National Park Service by philanthropist Laurance Rockefeller. While the land was deeded to the National Parks Service (NPS), the buildings remained under the ownership of Rockefeller’s company via a “retained use estate.” This arrangement included an indenture with a reversion clause, offering the government the option to acquire the resort buildings at no cost—otherwise, the land would revert to the resort’s owner.

The legal dispute intensified when EHI, having acquired the retained use estate, claimed full ownership of both the land and resort buildings after the government declined a 2019 offer to assume ownership. EHI interpreted this “offer” as a sales proposition, whereas the government viewed it as a no-cost conveyance.

Judge Cheryl Ann Krause clarified this discrepancy in court, affirming the documents’ explicit intention for the land and improvements to be gifted to the government for a nominal fee of $1, as stipulated in the 1983 indenture. She stated, “To keep the land, the Government would have to accept the offer of the improvements. But if that offer were conditioned on payment, then the Government’s retention of that land, in effect, would also be conditioned on payments…meaning it would no longer be a gift.”

Judge Krause further underscored the non-commercial nature of the transaction, reflecting on the indenture’s clear direction for the integration of the Caneel Bay Resort into the Virgin Islands National Park, aligned with both parties’ philanthropic objectives.

Despite EHI’s arguments that the government intended to spend significantly to re-acquire the resort and their attempt to redefine “offer,” the court found these points unconvincing. Judge Krause dismissed these claims and awarded summary judgment to the United States, confirming that since no valid offer was made by EHI before the expiration of the retained use estate on September 30, 2023, the land’s title remains with the U.S. Government.

This ruling confirms that the government not only retains ownership of the land but also gains title to the resort’s structures, with EHI planning to appeal the decision. This marks a significant step towards the full integration of the Caneel Bay Resort into the national park system, reflecting the original intent of its benefactor.

-

Education1 year ago

Education1 year agoEducation Board Seeks Input on Schools Through Comprehensive Survey

-

Education2 years ago

Education2 years agoCTE Board Enthusiastic About New Curriculum Standards, Yet Anxious Over Apprenticeship Support

-

Crime2 years ago

Crime2 years agoRegistered Sex Offender Detained for Illegal Firearm Possession During Annual Surveillance Drive

-

Development1 year ago

Development1 year agoCosts Surge as Donoe Estates Housing Project Resumes with New Contractor

-

Videos2 years ago

Videos2 years ago2022 Gubernatorial Election: Voters Speak Out

-

Crime2 years ago

Crime2 years agoSt. John’s Westin Resort Scene of Armed Robbery, Prompting Heightened Police Vigilance

-

Videos3 years ago

Videos3 years agoGubernatorial Teams Celebrate St. Croix’s Bull & Bread Day

-

Videos2 years ago

Videos2 years agoWakanda’s Female Might: A Dive into ‘Black Panther: Wakanda Forever’