Business

Legislation to Extend Trade Name Registration Period Advances in Senate

In a significant development for the business community, Senator Alma Francis Heyliger, leveraging her business acumen, has introduced a transformative bill in the territory’s legislature. During the recent session of the Committee on Government Operations, Veteran Affairs and Consumer Protection, Senator Heyliger advocated for the proposal, drawing on her unique perspective as a business owner. The bill, known as 35-0084, seeks to revolutionize the current system where trade names are secured for a maximum of two years. Under the new legislation, businesses will have the flexibility to renew their trade or business names every 2, 6, or 10 years.

Denise Johannes, the Director of Corporations and Trademarks in the Office of the Lieutenant Governor, presented a neutral stance regarding the bill. She acknowledged the office’s neutrality but expressed concerns about the financial implications of implementing the proposed changes. Johannes highlighted the need for significant updates to the online portal for business name renewals. She estimated a 200-hour effort with a budget of $50,000 to make the necessary updates.

This fiscal demand led Ms. Johannes to request appropriated funds to manage the expenses. Additionally, the Division of Trademarks suggested a postponed effective date to facilitate system updates and thorough testing by staff.

Despite the apparent complexities and potential system glitches highlighted by Ms. Johannes, the bill’s merits were evident. Senator Carla Joseph raised concerns about the cost of these updates and the scope of the vendor’s responsibilities. In response, Ms. Johannes clarified that the bill’s requirements would be considered beyond the current scope of their operations.

To address these financial concerns, an amendment by Senator Francis-Heyliger proposed allocating funds from this fiscal year for the bill’s implementation, should it pass. The bill’s enactment is expected to take effect 180 days following its approval.

This bill, once enacted, will impact approximately 6,807 trade name registrations in the territory. In a testament to its potential benefits, the bill received favorable votes from the Committee on Government Operations, Veterans Affairs, and Consumer Protection, marking a positive step towards its eventual passage.

Business

The Rise of Eco-Friendly Businesses in the U.S. Virgin Islands

As the global focus on environmental sustainability continues to grow, the U.S. Virgin Islands has emerged as a hub for eco-friendly businesses. This shift reflects both local entrepreneurs’ commitment to preserving the islands’ natural beauty and the increasing demand from consumers for sustainable practices. From renewable energy solutions to sustainable tourism, the USVI is experiencing a green revolution that is reshaping its economy.

Sustainable Tourism: Leading the Way

Tourism is the backbone of the USVI economy, and the industry is undergoing a significant transformation. Many businesses are adopting eco-friendly practices to meet the growing demand for sustainable travel options. Hotels and resorts across the islands are implementing energy-efficient systems, reducing plastic waste, and sourcing local, organic produce for their restaurants.

For instance, some accommodations have integrated solar panels and water conservation systems, significantly reducing their environmental footprint. Additionally, eco-tours are becoming increasingly popular, offering visitors an opportunity to explore the islands’ pristine ecosystems while learning about conservation efforts. Kayak tours through mangrove forests and guided hikes through national parks are just a few examples of how tourism is being redefined in an eco-friendly context.

Renewable Energy: Powering the Future

Renewable energy is another sector where the USVI is making strides. With abundant sunshine and consistent trade winds, the islands are ideal for harnessing solar and wind energy. Several businesses and government initiatives are investing in renewable energy infrastructure to reduce dependency on imported fossil fuels.

One notable example is the push for solar energy installations across both residential and commercial properties. Solar farms are being developed to supply clean energy to the local grid, and many businesses are installing solar panels to power their operations. This shift not only reduces carbon emissions but also helps businesses save on energy costs, making them more competitive and sustainable.

Local Entrepreneurship and Innovation

Local entrepreneurs are at the forefront of the eco-friendly movement in the USVI. From organic farming to sustainable fashion, small businesses are driving innovation in various industries. These entrepreneurs are not only providing environmentally friendly products and services but also educating the community about the importance of sustainability.

For example, local farmers are embracing organic and regenerative farming practices, producing fresh, chemical-free produce for the local market. This approach not only benefits the environment by preserving soil health and reducing chemical runoff but also supports the local economy by reducing reliance on imported goods.

In the fashion industry, businesses are focusing on sustainable materials and ethical production processes. By sourcing materials locally and minimizing waste, these companies are setting new standards for the industry in the Caribbean.

Challenges and Opportunities

While the rise of eco-friendly businesses in the USVI is promising, it is not without challenges. The high initial costs of renewable energy installations and sustainable infrastructure can be a barrier for some businesses. Additionally, the small size of the local market can limit the scalability of these initiatives.

However, these challenges also present opportunities for innovation and collaboration. Partnerships between the private sector, government, and non-profits can help overcome these barriers by providing financial incentives, technical support, and public awareness campaigns. As global interest in sustainability grows, the USVI has the potential to attract eco-conscious tourists and investors, further fueling its green economy.

The Future of Eco-Friendly Businesses in the USVI

The future looks bright for eco-friendly businesses in the USVI. As more companies adopt sustainable practices, the islands are poised to become a model for green business in the Caribbean. The combination of natural resources, entrepreneurial spirit, and a commitment to preserving the environment creates a unique opportunity for the USVI to lead the way in sustainable development.

For businesses in the USVI, going green is not just a trend but a necessary evolution to meet the demands of a changing world. As the global emphasis on sustainability continues to grow, the USVI’s eco-friendly businesses will likely thrive, contributing to the islands’ long-term economic and environmental resilience.

In conclusion, the rise of eco-friendly businesses in the USVI is a testament to the region’s dedication to sustainability and innovation. As these businesses continue to grow and evolve, they will play a crucial role in shaping a sustainable future for the islands, ensuring that the USVI remains a beautiful and thriving destination for generations to come.

Business

Vivot Group Files for Bankruptcy Amid Financial Crisis, Lender Lawsuit

The Vivot Group of Companies, a prominent full-service commercial construction firm in the U.S. Virgin Islands, has filed for bankruptcy, according to court documents obtained by the Consortium.

Jean Patrick Vivot, president of the conglomerate, is requesting joint administration for the bankruptcies filed individually by each of the ten companies in the group. These companies include Vivot Equipment Corporation, Eleven Construction, PSI Tire Supply, Axis Development, TTA Logistics, Valdez Industrial Group, Caribbean Crane & Rigging, Vivot Industries Virgin Islands, Abacus International, and Vivot Equipment. The group collectively owns approximately $64 million worth of equipment, tools, and vehicles, alongside an additional $19 million in real property. However, they owe just over $56 million in secured debt, with the primary creditor being Touchmark National Bank of Georgia, to whom Vivot reportedly owes $31 million. The group also has a reported $13.5 million in unpaid taxes.

Mr. Vivot attributed the financial distress to the 2021 bankruptcy of Limetree Bay Services, which left the Vivot Group with $14.5 million in unpaid receivables. “Limetree’s liquidating bankruptcy, and its subsequent failure to pay the Limetree Receivables in full, caused the Vivot Group to endure significant financial and operational strain,” Mr. Vivot stated in his declaration. He further explained that a consensual out-of-court debt restructuring was deemed unfeasible after discussions with secured lenders.

Compounding the financial woes, Touchmark National Bank filed a lawsuit in early April, seeking to appoint a receiver for the Vivot Group. The lawsuit alleges that Vivot failed to repay debts and improperly reallocated assets designated as loan collateral. Touchmark claims that some equipment used as collateral was leased to third parties without consent, violating loan agreements.

The lawsuit details nine loans taken by Vivot companies between 2016 and 2019, with other group companies guaranteeing the loans and pledging all assets as collateral. Touchmark’s lawsuit reveals that a November 2023 spreadsheet indicated some collateral assets had been moved from St. Croix to other locations, including Puerto Rico and the mainland U.S. This movement and unauthorized leasing of equipment allegedly jeopardize the collateral’s value and hinder the bank’s ability to locate and liquidate it. Additionally, the bank asserts that Vivot violated loan agreements by allowing tax liens on properties used as collateral.

Touchmark has filed 95 complaints against the Vivot Group and Mr. Vivot, seeking a court judgment, the appointment of a receiver, and potential liquidation of collateral if the debtors fail to repay their obligations.

The bankruptcy filing temporarily halts Touchmark’s recovery efforts. Under Chapter 11 bankruptcy, the Vivot Group aims to reorganize its business, repay creditors over time, and continue operations. As “debtors-in-possession,” the group has requested court permission to use available cash for operating expenses.

For now, the Vivot Group is not in immediate danger of ceasing operations, but industry stakeholders are closely monitoring the situation as one of St. Croix’s largest construction service providers navigates its financial challenges.

Business

St. Croix Administrator Aims to Overturn New Trash Law Fines for Christiansted Business Owners

St. Croix Administrator Samuel Sanes is advocating for the rescission of fines levied against Christiansted business owners who were cited for violating a recently enforced trash law. These business owners claim they were unaware of the regulations. Mr. Sanes also seeks to engage with V.I. Waste Management Authority (WMA) officials to reconsider the enforcement strategies for this statute.

On May 23, WMA enforcement officers approached Christiansted business owners about their waste disposal methods. Upon learning that these businesses were using public trash receptacles, officers issued citations for violating VI Code Title 19, subsection 1563, which requires businesses to use the Anguilla Landfill or a commercial trash hauler. The sudden enforcement left many local business owners, including Maria Banwaree of Unique by Maria Banwaree Art Studio and Boutique, feeling distressed. Ms. Banwaree stated she was unaware of the law and felt coerced into signing the citations under threat of arrest. A week later, Mr. Sanes visited her store to personally apologize for the incident.

“He said in the name of the VI government he wants to apologize. He said that a couple of times. He says he feels so bad because we the people in Christiansted don’t need this,” Ms. Banwaree told this reporter. According to her, Mr. Sanes approached her following a meeting with WMA Executive Director Roger Merritt.

“I’ve spoken numerous times to the executive director for Waste Management, basically asking him to see if the charges can be dropped. I truly believe that a more comprehensive approach should have taken place. In other words, advise the business owners on the rules and regulations,” Mr. Sanes said.

Mr. Sanes noted the conflicting narratives—business owners claiming ignorance of the law, while WMA insists that a town hall meeting and other warnings were issued. He recommended to Mr. Merritt that all citations and fines be annulled, followed by a months-long informational campaign to ensure compliance among local businesses.

While proposing changes to the enforcement strategy, Mr. Sanes also questioned the practicality of the law, especially for very small businesses like Boardwalk vendors who generate minimal trash. “Are we going to demand that one vendor, which is a table, actually get a hauler, a trash hauler? For what, the possibility of a small bag of trash?” he asked. “It’s something that we really need to go back and explore.”

Mr. Sanes believes the law should be reconsidered, given the financial hardships Christiansted businesses have faced due to prolonged road repairs and closures. “It is a hardship for many small businesses at this time. So that’s one of the reasons why I approached Waste Management and I told them, let’s start all over again,” he said.

In response to her interaction with Mr. Sanes, Ms. Banwaree decided to collaborate with other nearby businesses to collectively engage a trash hauler. “We are organizing ourselves in advance, because we understand if we have information that we need to follow the law and follow the rules. But the thing is, they come before saying anything to us, just with the fine,” she said. She remains hopeful that the original fine will be reversed. “I hope that Mr. Sanes says the truth and I hope that the government really takes action,” Ms. Banwaree said.

In contrast, another business owner, Jan Mitchell of Mitchell Larsen Studio, who also received a citation and fine, was unaware of any efforts by Mr. Sanes to rescind the fines or any updates on the situation. “Maybe the whole thing will just pass and it’ll be fine with me. I hate making waves, I’m just not that kind of person, but I’m not going to not do anything if it calls for it. So we’ll see—it’ll play out,” she said.

As of press time, Mr. Merritt has not responded to numerous requests for comment, nor has WMA issued an official statement on the matter.

-

Education1 year ago

Education1 year agoEducation Board Seeks Input on Schools Through Comprehensive Survey

-

Education2 years ago

Education2 years agoCTE Board Enthusiastic About New Curriculum Standards, Yet Anxious Over Apprenticeship Support

-

Crime2 years ago

Crime2 years agoRegistered Sex Offender Detained for Illegal Firearm Possession During Annual Surveillance Drive

-

Development1 year ago

Development1 year agoCosts Surge as Donoe Estates Housing Project Resumes with New Contractor

-

Videos3 years ago

Videos3 years ago2022 Gubernatorial Election: Voters Speak Out

-

Videos3 years ago

Videos3 years agoGubernatorial Teams Celebrate St. Croix’s Bull & Bread Day

-

Videos3 years ago

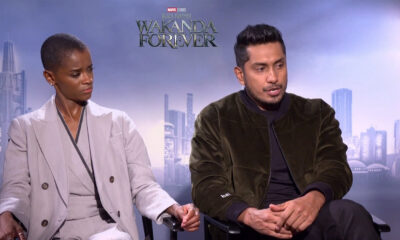

Videos3 years agoWakanda’s Female Might: A Dive into ‘Black Panther: Wakanda Forever’

-

Crime2 years ago

Crime2 years agoSt. John’s Westin Resort Scene of Armed Robbery, Prompting Heightened Police Vigilance